When financial challenges threaten your ability to keep up with mortgage payments, homeowners in Calgary have options beyond traditional foreclosure. One increasingly popular solution allows property owners to avoid lengthy legal battles while minimizing long-term credit damage.

This alternative strategy involves working directly with your lender to voluntarily transfer ownership of your home. Unlike standard foreclosure proceedings, this approach typically resolves faster and with less strain on your financial future. Many find it provides a clearer path forward during difficult circumstances.

The Second Mortgage Store, a trusted Calgary-based real estate resource (+1 403-827-6630), specializes in helping residents explore these alternatives. Their team emphasizes transparent communication about eligibility requirements and potential outcomes, ensuring you make informed decisions about your property.

Key Takeaways

- Offers faster resolution than traditional foreclosure methods

- Helps minimize negative impacts on credit scores

- Requires cooperation between homeowner and lender

- Avoids lengthy court processes in Alberta

- Provides structured exit strategy for unmanageable mortgages

Understanding the Deed in Lieu of Foreclosure Process

A voluntary ownership transfer agreement provides homeowners an alternative path when mortgage obligations become unsustainable. This legally binding arrangement allows property owners to return their home to the lender without drawn-out court proceedings. In Alberta, such agreements require mutual consent and thorough documentation to finalize.

Defining the Process and Its Legal Implications

Under this arrangement, homeowners formally relinquish property rights in exchange for debt forgiveness. Unlike forced repossessions, both parties negotiate terms directly. Legal requirements include proof of financial hardship and a clear title statement confirming no third-party claims on the property.

How It Differs from Traditional Foreclosure

Traditional foreclosure in Canada typically involves 6-12 months of court processes, while voluntary transfers often resolve in 60-90 days. Lenders generally prefer this method as it reduces administrative costs and vacancy risks. Homeowners benefit from avoiding public auction scenarios and minimizing credit score damage.

| Factor | Voluntary Transfer | Court-Ordered Repossession |

|---|---|---|

| Average Processing Time | 2-3 months | 6-12 months |

| Credit Impact Duration | 3-5 years | 7+ years |

| Legal Fees | $1,500-$3,000 | $5,000-$10,000+ |

Financial institutions typically require three months of payment default records before considering this option. Properly structured agreements may include provisions for partial debt forgiveness, though tax implications should be reviewed with professionals.

Key Benefits of Choosing a Deed in Lieu Over Foreclosure

Homeowners struggling with loans might find relief through strategic debt management options. This approach helps preserve financial stability while creating space for recovery. Let’s explore its core advantages.

Credit Impact and Debt Forgiveness

Voluntary property transfers typically reduce credit score damage by 30-50% compared to traditional methods. While both options appear on credit reports, lenders often view cooperative agreements more favorably. Industry data shows scores may drop 100-150 points instead of 200+ with forced repossession.

Many financial institutions forgive portions of unpaid balances under negotiated terms. The Second Mortgage Store notes this could eliminate 10-25% of remaining debt in some cases. Their advisors stress reviewing tax implications before finalizing agreements.

Time Savings and Cost Reduction

Resolving mortgage challenges through cooperation slashes timelines dramatically. While court processes average 9-18 months, voluntary transfers often conclude within 90 days. Legal fees rarely exceed $3,000—less than half the cost of standard proceedings.

Consider these comparisons:

- Document preparation: 2 weeks vs 6+ weeks

- Post-resolution credit recovery: 3 years vs 7+ years

- Stress reduction: Immediate clarity vs prolonged uncertainty

Though not ideal, this path offers a structured reset. As one financial counselor explains: “Proactive solutions minimize collateral damage while opening doors to future opportunities.”

Essential Steps to Initiate the Process in Calgary

Taking control of your financial situation begins with understanding the practical actions needed to address mortgage challenges. Organized preparation and strategic communication form the foundation of successful resolutions.

Preparing Necessary Documentation

Start by collecting three months of bank statements, recent pay stubs, and tax returns. Lenders typically require proof of income changes or unexpected expenses. A clear payment history showing missed installments strengthens your case for alternative solutions.

Organize these records chronologically in both digital and physical formats. Include written explanations for income gaps or large withdrawals. Financial advisors recommend highlighting patterns like medical bills or job loss to demonstrate genuine hardship.

Engaging in Lender Negotiations

Contact your bank’s loss mitigation department to schedule a formal discussion. Present your documentation upfront to show commitment to resolving the issue. Many institutions offer dedicated portals for uploading files securely before meetings.

Key negotiation strategies include:

- Requesting temporary payment reductions while finalizing terms

- Asking about partial loan forgiveness options

- Proposing realistic timelines for property transfers

Local experts like The Second Mortgage Store (+1 403-827-6630) can review your materials beforehand. Their team often identifies overlooked details that streamline approvals. Proper preparation reduces back-and-forth communication, helping resolve matters in weeks rather than months.

When to Consider a Deed in Lieu of Foreclosure Calgary

Persistent financial strain may signal the need to explore alternative solutions for unsustainable housing costs. Property owners should evaluate their situation when monthly obligations consistently exceed income, particularly if market conditions limit equity growth.

Assessing Financial Hardship and Home Equity

Three consecutive missed mortgage payments often indicate deeper financial trouble. Homeowners should calculate their loan-to-value ratio – if owed balances exceed 90% of the property’s current worth, traditional refinancing becomes unlikely. Recent Alberta market shifts have left some residents with shrinking equity buffers.

Consider these warning signs:

- Using credit cards for basic living expenses

- Property value declines exceeding 15%

- Income reductions lasting 6+ months

Comparing Resolution Paths

Strategic transfers often work best when other options prove unfeasible. This table outlines key differences:

| Solution | Timeframe | Credit Impact | Eligibility |

|---|---|---|---|

| Loan Modification | 45-60 days | 50-75 point drop | Stable income required |

| Short Sale | 4-6 months | 100-150 point drop | Buyer must be secured |

| Strategic Transfer | 2-3 months | 80-120 point drop | Documented hardship |

“Early intervention often determines whether homeowners recover financially or face years of setbacks,” notes a mortgage advisor with The Second Mortgage Store.

Those with temporary income drops might prefer repayment plans, while individuals needing complete debt relief could benefit more from structured transfers. Market analysis tools from local experts help assess whether property values might rebound soon.

Always consult licensed professionals before deciding. Solutions vary based on employment status, tax considerations, and provincial regulations. Contact The Second Mortgage Store at +1 403-827-6630 for personalized Calgary market insights.

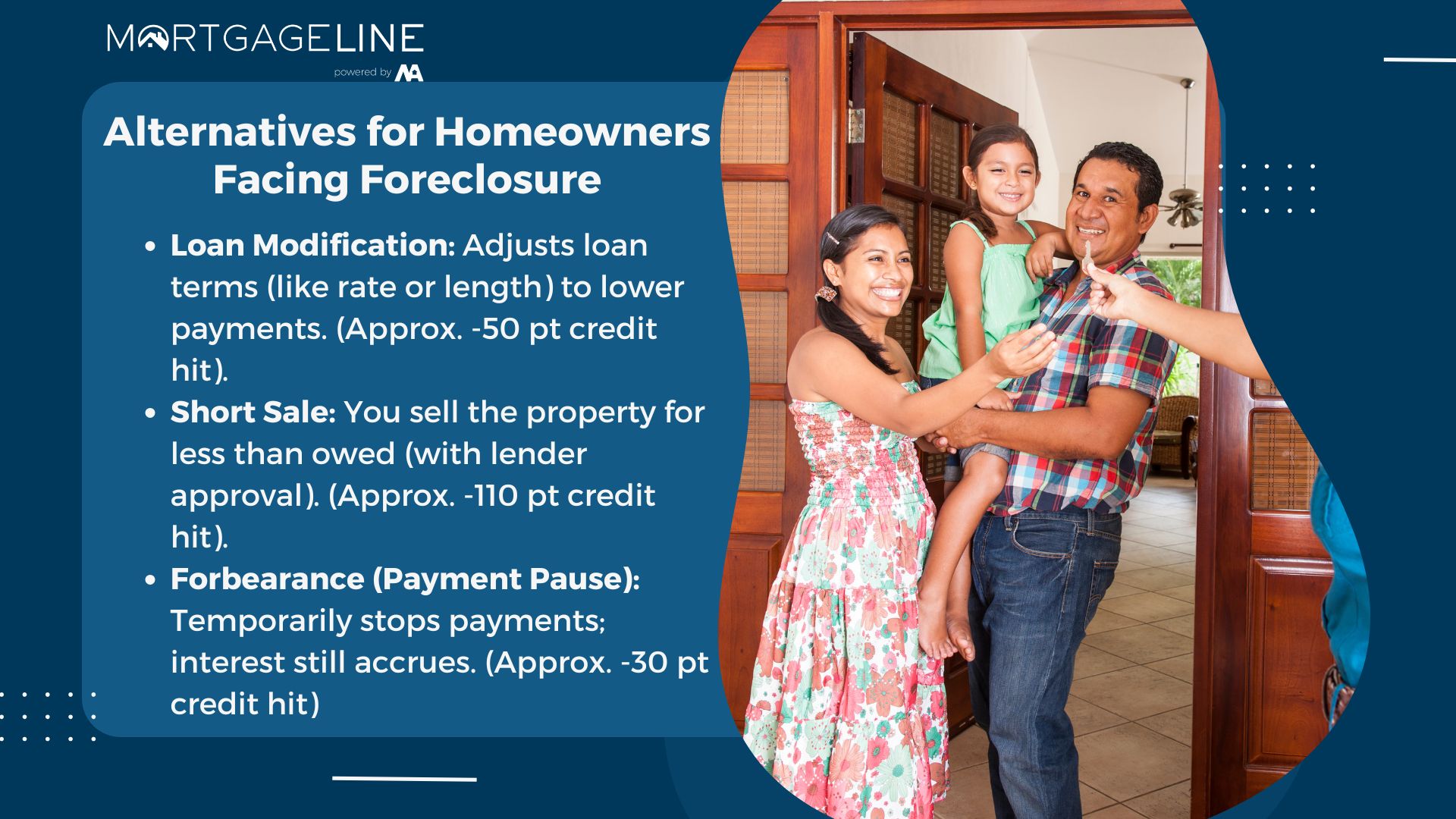

Alternatives for Homeowners Facing Foreclosure

Exploring different strategies can help homeowners regain financial stability while protecting their credit health. Each path offers unique advantages depending on your circumstances and long-term goals.

Loan Modification and Short Sale Options

Loan adjustments let borrowers renegotiate terms with lenders. This might include lowering interest rates from 5% to 3% or extending repayment periods by 10-15 years. Recent data shows 62% of successful modifications reduce monthly payments by $300+.

Short sales involve selling properties for less than owed balances. Unlike voluntary transfers, these require finding buyers and lender approval. They typically take 4-6 months but leave smaller credit dents than court-ordered repossessions.

Forbearance and Repayment Plans

Temporary payment pauses help during job transitions or medical crises. Most plans last 3-12 months, with paused amounts added to later installments. While helpful short-term, 28% of borrowers face higher payments afterward.

| Solution | Credit Impact | Timeline | Costs |

|---|---|---|---|

| Loan Adjustment | -50 pts | 60 days | $500 fees |

| Short Sale | -110 pts | 5 months | 7% commission |

| Payment Pause | -30 pts | Immediate | Interest accrual |

The Second Mortgage Store team emphasizes personalized assessments. “What works for empty nesters might crush young families,” their advisors note. Professional guidance ensures you balance immediate relief with future borrowing capacity.

Preventative Measures to Avoid Foreclosure

Protecting your home from financial distress starts with proactive planning and smart money management. Early intervention often prevents minor setbacks from becoming major crises. Let’s explore practical strategies to maintain stability and preserve your credit health.

Maintaining Consistent Mortgage Payments

Create a detailed budget that prioritizes housing costs. Studies show 60% of homeowners who track expenses avoid payment issues. Set up automatic transfers two days before due dates to prevent late fees. Review loan terms annually to identify refinancing opportunities when rates drop.

Consider these protective steps:

- Build a 3-month emergency fund for unexpected expenses

- Renegotiate interest rates before missing payments

- Use windfalls like tax refunds to make extra principal payments

Seeking Financial Counseling and Professional Advice

Contact certified credit counselors at the first sign of trouble. Many nonprofit agencies offer free consultations to assess your property’s financial condition. These experts help restructure debts and communicate with lenders on your behalf.

“Addressing payment gaps within 30 days increases resolution success rates by 73%,” advises a consumer finance specialist from Money Mentors Canada.

Lenders often provide temporary relief programs if contacted early. Options might include 6-month payment reductions or interest-only periods. Document all communications and keep records organized for future reference.

The Role of Local Experts: The Second Mortgage Store

Navigating complex real estate decisions becomes more manageable with experienced professionals guiding the process. Local specialists bring critical insights into regional market trends and lender expectations that generic advisors might miss.

Tailored Solutions for Property Challenges

The Second Mortgage Store delivers customized strategies for homeowners facing difficult financial choices. Their team analyzes individual circumstances to identify solutions that balance immediate needs with future goals. “Every situation requires unique consideration,” notes their lead advisor.

Key advantages of their approach include:

- Detailed analysis of lender requirements

- Insider knowledge of regional property values

- Streamlined documentation processes

Accessible Support When You Need It

Calgary residents can connect directly with The Second Mortgage Store at +1 403-827-6630 for confidential consultations. Their office handles everything from initial paperwork to final negotiations, reducing stress for overwhelmed homeowners.

Local expertise proves particularly valuable when:

- Understanding hidden costs in financial agreements

- Communicating effectively with credit institutions

- Timing transactions to market conditions

“Having a knowledgeable ally makes all the difference in achieving favorable outcomes.”

Navigating Lender Requirements and Documentation

Financial institutions evaluate several critical factors when reviewing requests for alternative property solutions. Meeting their standards requires understanding specific criteria and organizing key records effectively. Proper preparation increases approval chances while reducing processing delays.

Understanding Lender Criteria

Banks prioritize three elements: consistent payment history, current market valuations, and clear ownership status. Most require proof of at least 90 days payment delinquency before considering alternative arrangements. Recent appraisals must show the property’s value aligns with regional trends.

Lenders typically reject applications with:

- Outstanding liens or secondary loans

- Evidence of property damage

- Incomplete financial disclosures

| Document Type | Purpose | Timeline |

|---|---|---|

| Tax Returns | Verify income stability | Last 2 years |

| Bank Statements | Track payment patterns | 3-6 months |

| Appraisal Report | Confirm property value | Within 30 days |

Key Records to Gather for Approval

Start by collecting loan agreements, insurance policies, and communication records with your financial institution. Digital copies should match physical documents exactly. Organize files chronologically to demonstrate transparency.

Common pitfalls include missing notarized forms or expired identification. Industry reports show 40% of applications get delayed due to unsigned pages. Double-check all materials before submission.

“A well-prepared package speaks volumes about your commitment to resolving matters responsibly.”

Set calendar reminders for lender deadlines and follow up within 48 hours of submissions. Professionals recommend creating checklists to track each step in the process.

Managing Financial Challenges with Structured Options

Financial difficulties can create overwhelming pressure, but structured solutions exist to help regain control. Tailored repayment strategies and lender negotiations often unlock paths to stability that many borrowers overlook.

Exploring Debt Relief and Loan Forgiveness Opportunities

Effective negotiations with lenders can reduce outstanding balances by 15-30% in many cases. Start by requesting written confirmation of any forgiven amounts to avoid future disputes. Some institutions offer tiered forgiveness programs based on payment history and property value.

Consider these approaches:

- Request lump-sum settlements for 60-80% of current balances

- Propose adding forgiven amounts to future tax filings

- Combine payment extensions with interest rate reductions

| Strategy | Immediate Savings | Long-Term Impact |

|---|---|---|

| Partial Forgiveness | $8,000-$15,000 | Credit recovery in 2-4 years |

| Extended Terms | 25-40% lower payments | Longer debt timeline |

Structured plans often cut legal fees by 50% compared to standard proceedings. The Second Mortgage Store’s negotiators frequently secure waived penalties for clients, saving an average of $2,100 per case. Proper documentation proves critical – include bank records showing consistent efforts to meet obligations.

“Successful resolutions balance short-term relief with sustainable financial health,” notes a debt specialist. “We help clients present compelling cases that demonstrate commitment to resolution.”

Build your proposal with three key elements: verified income statements, comparative market analyses, and a detailed hardship letter. These materials help lenders assess risk while showing your dedication to responsible solutions.

Conclusion

Facing mortgage difficulties requires careful evaluation of solutions that protect both financial health and property value. Voluntary agreements with lenders often provide faster resolutions than court processes while reducing long-term credit impacts. Homeowners preserve more control over their situation through cooperative strategies rather than forced proceedings.

Timely action proves critical when addressing housing payment challenges. Early engagement with professionals helps streamline documentation and negotiation phases. This approach minimizes stress while maintaining clearer paths to financial recovery.

Key advantages include avoiding public records of forced sales and reducing legal fees significantly. Structured agreements may also offer partial debt relief depending on individual circumstances. Always review tax implications and market conditions before finalizing decisions.

Those exploring alternatives should consult trusted advisors familiar with regional regulations. The Second Mortgage Store (+1 403-827-6630) offers tailored guidance to navigate complex lender requirements effectively. Their expertise helps homeowners make informed choices aligned with current financial realities.

Take the first step toward stability today. Evaluate your options with expert support to create a sustainable path forward.