Did you know that thousands of homeowners in Calgary face the daunting threat of a power of sale every year? This legal process is initiated when mortgage payments are missed, leaving homeowners in a precarious financial situation. Unlike foreclosure, where the lender takes ownership, a power of sale allows the lender to sell the property to recover the debt.

The Second Mortgage Store specializes in providing effective solutions to stop power of sale proceedings, helping Calgary residents retain their homes and rebuild financial stability. With expert guidance, homeowners can navigate through the complex mortgage process and avoid the pitfalls of foreclosure.

Key Takeaways

- Understanding the power of sale process is crucial for homeowners in Calgary to avoid financial pitfalls.

- The Second Mortgage Store offers tailored mortgage solutions to stop power of sale.

- Timely intervention is key to halting power of sale proceedings.

- Expert guidance can help navigate through financial difficulties.

- Homeowners in Calgary can rebuild financial stability with the right support.

Understanding Power of Sale in Calgary

Understanding the power of sale is crucial for Calgary homeowners facing financial difficulties. The power of sale is a legal rule that allows a lender to sell a property without foreclosure when a homeowner defaults on their mortgage payments.

- Power of sale in Calgary allows mortgage lenders to sell a property when homeowners default.

- Alberta has specific regulations governing the power of sale process.

This process enables lenders to recover their debt while potentially returning surplus funds to homeowners.

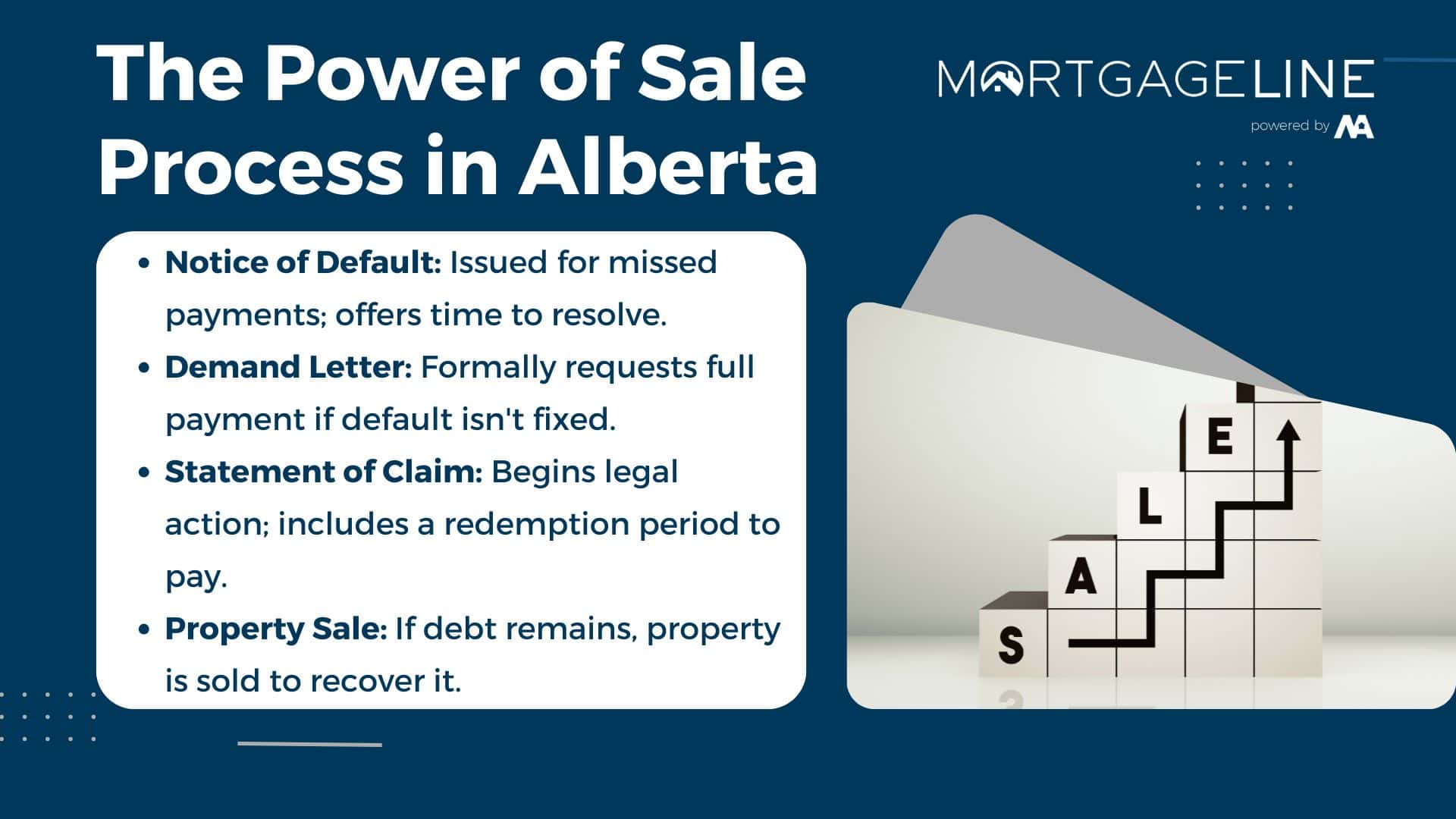

The Power of Sale Process in Alberta

When a homeowner in Alberta falls behind on mortgage payments, the lender may initiate the power of sale process, a series of legal steps to recover the debt. This process is governed by a structured legal framework designed to protect both the lender’s and homeowner’s rights.

Notice of Default

The power of sale process begins with a Notice of Default, issued by the lender after missed mortgage payments. This notice gives the homeowner a specified period, usually 15 days, to rectify the default.

Demand Letter

If the homeowner fails to resolve the default, the lender sends a Demand Letter, formally requesting full payment of the outstanding amount. This letter signifies a critical escalation in the power sale process.

Statement of Claim

Should the situation remain unresolved, the lender issues a Statement of Claim, initiating formal legal proceedings. This marks the beginning of a redemption period during which the homeowner can still pay the overdue amount to halt the process.

Property Sale

If the redemption period expires without resolution, the lender proceeds to the final stage: the Property Sale. The property is sold, often below market value, to recover the debt owed to the lender.

- The power of sale process in Alberta is a structured legal procedure.

- It begins with a Notice of Default after missed mortgage payments.

- A Demand Letter is issued if the default isn’t resolved, requesting full payment.

- A Statement of Claim initiates legal proceedings and a redemption period.

- If unresolved, the process ends with the Property Sale to recover the debt.

Consequences of Power of Sale for Homeowners

Facing a power of sale can have far-reaching consequences that impact not just your home, but your overall financial stability and personal well-being. When a power of sale concludes with the sale of your property, you may receive the remaining equity after the lender recovers their debt.

This amount is often significantly reduced due to legal fees, administrative costs, and potential below-market selling prices. The consequences extend beyond financial loss, affecting credit scores, family stability, and overall quality of life.

- A completed power of sale can severely damage your credit score.

- Homeowners may experience extreme stress and emotional distress.

- Forced relocation can disrupt family stability.

- In Calgary’s competitive housing market, re-entering may be challenging.

Understanding these consequences highlights the importance of taking immediate action when facing potential power of sale situations.

How to Stop Power of Sale Calgary

Halting a power of sale in Calgary requires immediate action and a thorough understanding of the available options. Homeowners can stop the process by paying off the overdue amount or refinancing their mortgage.

Several strategies can be employed to stop a power of sale:

- Bringing mortgage payments up to date by paying all outstanding amounts, including penalties and legal fees.

- Negotiating directly with the lender to arrange a payment plan or temporary modification.

- Refinancing the existing mortgage with a new lender offering more favorable terms.

- Securing a second mortgage or home equity loan to access the equity in the home.

- Selling the home voluntarily before the power of sale completes.

- Seeking professional assistance from mortgage specialists like The Second Mortgage Store.

- Obtaining legal advice from a real estate lawyer to identify potential defenses or procedural issues.

By taking prompt action and utilizing the right resources, homeowners in Calgary can effectively stop the power of sale process and protect their homes.

The Second Mortgage Store: Your Calgary Power of Sale Solution

The Second Mortgage Store has established itself as a trusted partner for homeowners in Calgary dealing with power of sale issues. With deep expertise in Alberta’s mortgage regulations and the Calgary real estate market, they offer tailored strategies to address each homeowner’s unique financial situation.

The Second Mortgage Store provides comprehensive services, including financial assessment, lender negotiation, refinancing options, and second mortgage arrangements, all designed to stop power of sale. Their team works directly with lenders, legal professionals, and financial institutions to negotiate on behalf of homeowners facing power of sale proceedings.

Unlike traditional banks, The Second Mortgage Store offers flexible mortgage solutions that consider your current financial challenges while focusing on long-term stability. With a proven track record of helping hundreds of Calgary homeowners retain ownership of their homes, they combine urgency with strategic planning to address immediate threats and establish sustainable financial solutions.

For a confidential consultation, Calgary homeowners can contact The Second Mortgage Store at +1 403-827-6630 to discuss their power of sale situation and explore available mortgage solutions.

Refinancing Options to Stop Power of Sale

Refinancing presents a critical opportunity for Calgary homeowners to address mortgage defaults and halt power of sale proceedings. By exploring refinancing options, homeowners can potentially rectify their financial situation and retain ownership of their home.

Traditional Mortgage Refinancing

Traditional mortgage refinancing involves replacing the existing mortgage with a new one, potentially offering better terms, lower interest rates, or extended amortization periods. This can reduce monthly payments and provide the necessary funds to pay off arrears, thus stopping the power of sale process. Homeowners can consolidate other debts into a single, more manageable payment.

Second Mortgages

A second mortgage allows homeowners to access their home’s equity without disturbing the primary mortgage, particularly beneficial when the first mortgage has favorable interest rates. By leveraging the built-up equity, homeowners can obtain the funds needed to resolve arrears with their primary lender and halt the power of sale proceedings.

- Refinancing can address the underlying financial issues causing mortgage default.

- Homeowners can access their home equity through a second mortgage or HELOC to cover arrears.

- The Second Mortgage Store specializes in arranging refinancing options for Calgary homeowners facing power of sale.

Private Lending Solutions for Power of Sale

For Calgary homeowners facing power of sale, private lending solutions offer a lifeline when traditional financing options are exhausted. Unlike conventional lenders, private mortgage lenders can make quick decisions based primarily on the equity in your home.

Private lending solutions are particularly valuable during power of sale situations, where time is critical. These lenders offer short-term mortgage solutions designed to resolve the immediate crisis while providing time to improve your financial situation.

| Key Benefits | Private Lending | Traditional Lending |

|---|---|---|

| Approval Time | Quick | Lengthy |

| Credit Score Focus | No | Yes |

| Equity-Based | Yes | No |

The Second Mortgage Store maintains relationships with numerous reputable private lenders in Calgary who specialize in helping homeowners stop power of sale proceedings. Private lending solutions can be structured as first or second mortgages, providing flexible financing options to address your needs.

Benefits of Working with The Second Mortgage Store

Homeowners in Calgary can rely on The Second Mortgage Store for comprehensive support and customized mortgage options to address power of sale issues. The company’s expertise in the local real estate market ensures that clients receive tailored solutions to their specific needs.

Expertise in Calgary Real Estate Market

The Second Mortgage Store’s deep understanding of Calgary’s real estate dynamics allows for accurate assessments of property values and equity positions. This expertise is crucial in developing effective power of sale solutions that consider local market conditions and lending practices.

Fast Response and Solutions

The Second Mortgage Store offers rapid response times, with initial consultations available within 24 hours. Their established relationships with various lenders enable them to present potential financing solutions within days, providing timely relief to homeowners facing power of sale.

- Customized mortgage solutions tailored to individual needs

- Expert guidance throughout the power of sale resolution process

- Transparent approach to ensuring clients understand all costs and terms

- Long-term support to prevent future financial difficulties

By working with The Second Mortgage Store, Calgary homeowners can stop power of sale proceedings and explore viable mortgage solutions to retain their homes. For more information, call +1 403-827-6630.

Steps to Take When Facing Power of Sale

When facing a power of sale in Calgary, homeowners must take immediate action to protect their property and financial well-being. The process can be complex and daunting, but by understanding the necessary steps, individuals can better navigate this challenging situation.

Act Quickly

The power of sale process in Alberta moves rapidly, making an immediate response crucial. Every day of delay reduces available options and increases potential costs.

Gather Your Documentation

Collecting all relevant financial documents is essential. This includes mortgage statements, notices from your lender, proof of income, property tax assessments, and any correspondence related to your mortgage situation. Organizing these documents will expedite the solution process.

Contact The Second Mortgage Store

Reach out to The Second Mortgage Store at +1 403-827-6630 as soon as you receive any notice related to mortgage default or power of sale. Their team offers free initial consultations to assess your situation, explain your options, and develop a customized strategy to stop the power of sale process.

To qualify for assistance, you’ll typically need:

- Sufficient Home Equity: Enough equity to refinance or secure a second mortgage.

- Proof of Income: Show proof of income or a clear repayment plan for the new financing solution.

- Up-to-Date Property Taxes: Property taxes must be current or factored into the financing solution.

- Willingness to Act Quickly: Time is critical; contacting The Second Mortgage Store immediately is essential to explore your options.

| Requirements | Description |

|---|---|

| Sufficient Home Equity | Enough equity to refinance or secure a second mortgage |

| Proof of Income | Show proof of income or a clear repayment plan for the new financing solution |

| Up-to-Date Property Taxes | Property taxes must be current or factored into the financing solution |

The key to resolving power of sale situations lies in prompt action and a thorough understanding of your financial situation.

Power of Sale vs. Foreclosure: Understanding the Difference

In Calgary, the processes of power of sale and foreclosure are two different paths that lenders may take when homeowners default on their mortgages.

Power of sale is a contractual right allowing the lender to sell the property to recover the debt without taking ownership. In contrast, foreclosure is a legal process where the lender takes actual ownership of the property.

Key differences include the speed of the process, with power of sale being generally faster, and the handling of surplus funds from the sale of the property.

- Power of sale returns surplus funds to homeowners.

- Foreclosure allows lenders to keep all proceeds.

Understanding these differences is crucial for Calgary homeowners facing mortgage default.

Protecting Your Home Equity During Power of Sale

Protecting home equity is crucial for homeowners in Calgary dealing with power of sale, as it directly impacts their long-term financial security.

When a home is sold through power of sale, it is often at a discounted price, as lenders prioritize recovering their funds quickly rather than maximizing the sale price. This can result in significant equity loss for homeowners.

Legal fees, penalties, and administrative costs associated with power of sale can further erode your equity, sometimes consuming tens of thousands of dollars of wealth you’ve built in your home.

- Taking proactive steps to stop power of sale before it reaches the property sale stage is the most effective way to protect your home equity.

- If stopping the power of sale entirely isn’t possible, negotiating a voluntary sale with your lender’s cooperation can often result in better prices than forced sales, preserving more of your equity.

The Second Mortgage Store helps Calgary homeowners protect their home equity by exploring all available options to either prevent the sale or ensure it happens on the most favorable terms possible.

Home equity represents one of the most significant wealth-building assets for most families, making its protection particularly important for long-term financial security.

Contact The Second Mortgage Store Today

For Calgary residents facing power of sale, expert guidance is just a call away at The Second Mortgage Store. Our team of mortgage specialists is ready to help you understand your options and develop a strategy to stop power of sale proceedings.

- Immediate assistance and expert guidance available by calling +1 403-827-6630.

- Free, no-obligation consultations for Calgary homeowners concerned about power of sale.

- Personalized service with an understanding of Alberta’s mortgage regulations.

Don’t wait until it’s too late—the earlier you contact us, the more options you’ll have to keep your home and protect your equity. The Second Mortgage Store has a proven track record of helping Calgary homeowners stop foreclosure and power of sale proceedings.

Contact us today to take the first step toward resolving your power of sale situation and securing your financial future.

Conclusion

Calgary residents can stop power of sale and foreclosure with the right knowledge and support. The Second Mortgage Store offers customized mortgage solutions to help homeowners navigate these challenges and keep their homes.